5 Tips To Make Digital Payments Easier For Ecommerce by Dan Rowinski. Available from <https://arc.applause.com/2017/06/28/digital-payments-ecommerce-best-pratices/> June 28, 2017

The payment is the painful part. Don’t make it any harder than it already is.

Retailers call it the moment of truth.

It’s that moment when a customer, finally, takes out their card and pays for an item. For many retailers, getting to this moment has been a long, arduous process filled with marketing, advertising, omnichannel touch points and several return visits from the potential customer.

For ecommerce sites, the payment—that oh so critical moment—is often non-intuitive and frustrating for the customer. Payment can feel like Hunter S. Thompson in Fear And Loathing In Las Vegas when on the depths of an ether binge; “You approach the turnstiles and know that when you get there, you have to give the man two dollars or he won’t let you inside. But when you get there, everything goes wrong.”

Payments are all about trust, security, privacy, speed and flow. Especially on websites where the customer is not physically holding a product they are going to walk out of the store with, the payment needs to provide the assurance that customer is getting exactly what they want and that their information is secure. Payment gateways that are slow or non-intuitive greatly increase the likelihood that the customer will ditch the product and never come back to the website.

I experienced an example of this kind of behavior recently. I was looking for a very specific piece for a gadget I was trying to fix. I went to an online store that specializes in such things, found what (I think) was the right item and put it into my shopping cart. When I went to check out, I entered all of my shipping information and went to pay … and was transferred to a third-party, bare bones site. No branding, no certification, no product information for what I was ordering. Just a few fields for my credit card number.

I backed out of the page, abandoned the purchase and never went back.

To develop trust with the customer, improve conversions and make the moment of truth as seamless for the customer as possible, here are five best practices for accepting payments on ecommerce sites.

Keep It Simple, Functional And Seamless

When people are buying things, they don’t want to feel like they are taking an online quiz or providing every last detail of their lives. To customers, payments are a necessary evil and they don’t want to be reminded that all of their information is getting put into your omnichannel marketing and retargeting strategies.

According to Internet Retailer, shopping cart abandonment happens at checkout stage (46.1%) with 37.4% abandoning a cart at the checkout login stage. More than a fifth of abandoned carts are when people fill out their billing address (20.9%) or shipping/delivery address (20%).

In terms of design, remember that the payments page is literally the final stage of the customer journey. Despite the temptation to upsell a customer or point them towards other products, marketing and advertising have no spot in the payments place. Payment pages should ask only for essential information and have the company logo prominently displayed within the normal website framework.

Customer flow should be unambiguous. The process from adding an item to a cart to checkout should be clearly labeled and bring customers to a payments page that is clear in its purpose. Do not redirect customers to another site that handles purchasing information (as was the case with PayPal in earlier years of ecommerce), but rather have the full, integrated payments portal as part of the ecommerce site itself.

Provide Plenty Of Digital Payment Options

Online payments have evolved over the years.

Most ecommerce sites and payment providers have taken a queue from Amazon in this regard. Amazon’s “one click” payment process opened the eyes of other ecommerce sites by proving it can be simple and easy to get from shopping cart to purchase decision.

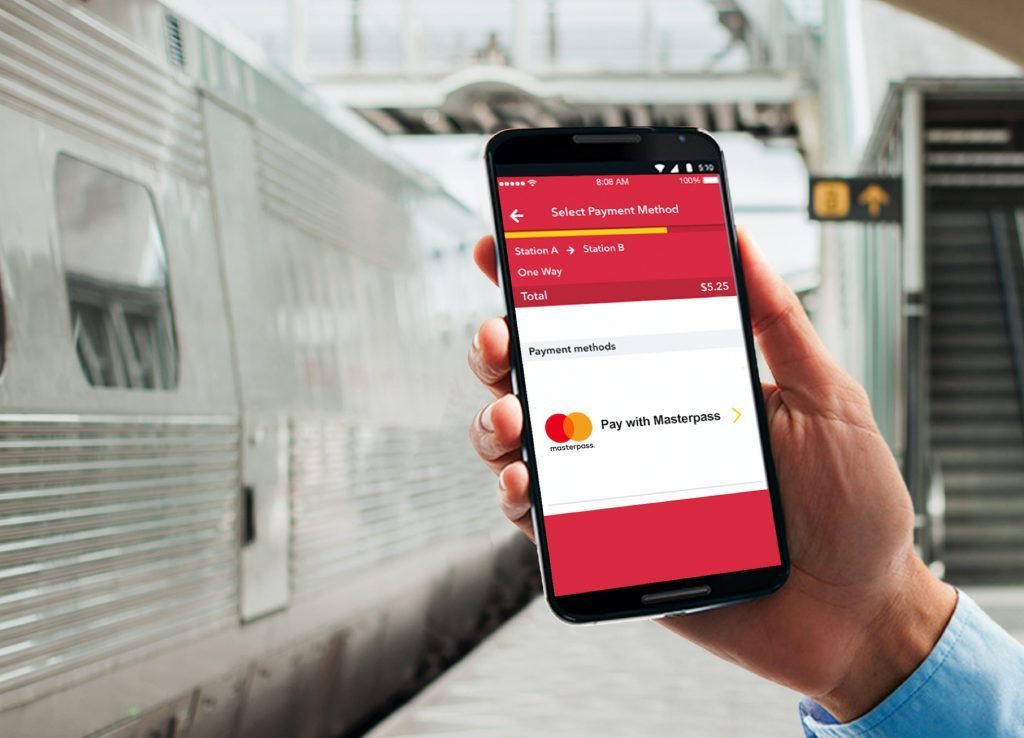

Payment portal providers have taken note of this and have attempted to take all of the frustration out of the process by bundling payment information with customer billing and shipping data. This is the inevitable mix of Oauth-like online identity systems and payments. Today, digital payment options like Android Pay, Apple Pay, PayPal and Mastercard’s Masterpass make it easy to integrate customer details into the payment process with one click. If you want to have an Amazon-like purchase experience, Amazon will actually help you with that through its Amazon Pay service.

In addition to the adoption of the new digital payment methods from the large technology companies, ecommerce sites should also have a “standard” payment option for customers that have not opted in to digital payment methods from the likes of Google, Apple, Amazon, PayPal, Mastercard or Visa. Standard payment fields that ask for card details, shipping and billing information are available through a variety of payment providers including PayPal’s Braintree, Stripe and Authorize.net.

Assure Payments Are Secure And Private

When you use some of the standard payment portals from trusted resources, security and privacy of customer data is baked into the product.

The trick is to make sure your customers can see that their information is being protected and trust that data is secure and private. According to eConsultancy, 58% of people will abandon a cart based on security concerns.

Table stakes in ecommerce security on websites is to make sure data coming in and out of your site is encrypted through HTTPS, which adds Secure Socket Layer (SSL) encryption to websites. Google uses HTTPS integration into account for site rankings in search results, so it is an important function to just about any site on the Web. In addition, payments need to be PCI Security Standards Council compliant. Payment gateway providers should be PCI compliant by default, but it doesn’t hurt to have both SSL and PCI badges on a payments page to ensure customers of their data security.

In terms of privacy, the best practice is to not sell your customers’ data to third parties. And those rules should be spelled out very clearly in a company’s terms of service and reiterated in a note on the payments page itself. Companies should be as transparent as possible with customers on how data is being used (whether for marketing, loyalty or promotional campaigns etc.). Transparency builds trust, which is the greatest cache that a brand has with its customers.

Allow Guests To Checkout

On the Web, discovery is a sideways affair. People will start looking for a product through a search or from social media or an email from a friend. Most customers are not loyal members … they just want what they want and they want it now. Your brand is but the vessel.

A good way to make these customers abandon their cart and never come back is to force them to sign up for your site with user account, password and profile details. The law of averages will tell you (if you have good data insights) which customers are repeat buyers and are open for deals, loyalty and marketing programs.The lesson: don’t be data greedy. Take what you can get by allowing a customer to check out as guests, supplying the bare bones of information to get them from product discovery to checkout.

Calls To Action: Before And After

Continue reading “5 Tips To Make Digital Payments Easier For Ecommerce”